In the first of a two-part series Oliver Page investigates what data and analysis services are available to British clubs, how they are currently utilising them for recruitment, and what effect this might be having on the UK transfer market.

“Economic efficiency is likely to be greatest when information is comprehensive, accurate and cheaply available.”

(The Economist, A-Z of Economics, online 2014)

At the OptaPro Analytics Forum a recurring question was “For which leagues is it possible to reproduce the work being discussed?” Almost all of the presentations utilised data from the Opta f24 data feed for the English Premier League. This data includes descriptions of every on-ball action and corresponding x-y coordinates to determine location around the pitch (as seen on websites such as Squawka and Statszone). My personal interest has always been greatest in domestic football outside of the Premier League so I was disappointed to learn that Opta do not currently provide this level of data for the Scottish Premier League or English League One and League Two. The only data that is available is 'headline stats' such as goals scored and assists.The full detail dataset for the English Championship only became available midway through the current 2013/14 season.

My dream of becoming the lower league Billy Beane is temporarily on hold.

More importantly however, this raises the question whether or not clubs are able to scout and compare players in these divisions as accurately as elsewhere?

What effect is this lack of data having on the recruitment of players at clubs playing in these ‘black hole’ divisions?

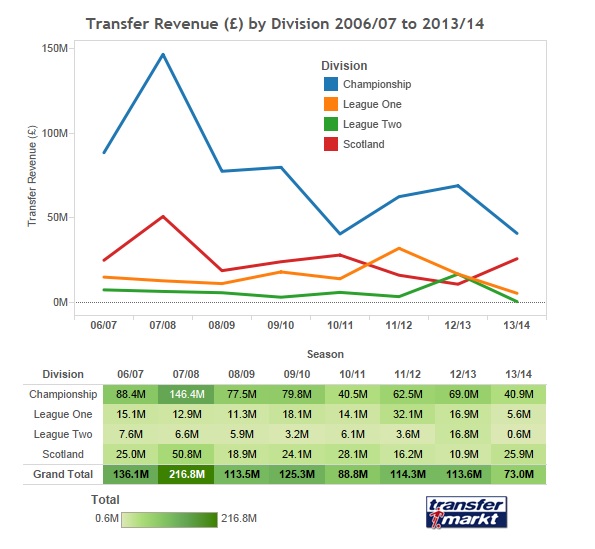

What Exactly Is The Problem? The website Transfermarkt keeps a comprehensive record of every major transfer and its value. Historic values are adjusted to reflect current market prices [see note 1 at end of article]. The chart and table below show transfer revenue generated by the English Championship, League One, League Two and Scottish Leagues over the previous 8 seasons.  [see notes 2 & 3 for further notes on methodology] We can see that transfer revenue generated by these divisions peaked in the 2007/08 season, after which the general trend has been one of steady decline. Scottish leagues did see an increase in 13/14 although this is almost entirely due to sales by Celtic alone. The 07/08 peak coincided with the start of a lucrative new broadcasting rights deal for the Premier League. The EPL recently signed another record rights deal meaning there is now more money than ever in the top division, yet this time it has not been matched by a similar boom in domestic transfers.

[see notes 2 & 3 for further notes on methodology] We can see that transfer revenue generated by these divisions peaked in the 2007/08 season, after which the general trend has been one of steady decline. Scottish leagues did see an increase in 13/14 although this is almost entirely due to sales by Celtic alone. The 07/08 peak coincided with the start of a lucrative new broadcasting rights deal for the Premier League. The EPL recently signed another record rights deal meaning there is now more money than ever in the top division, yet this time it has not been matched by a similar boom in domestic transfers.

For these 4 divisions 2013/14 represents the lowest combined total transfer revenue since 2004/05.

Why does this matter? Recruitment is often only considered in terms of teams trying to sign players, yet for all but a minority of clubs their ability to sell players efficiently is equally crucial to their financial performance. Clubs outside the English Premier League are concerned about the current financial climate and the potential impact of new Financial Fair Play rules. Some are even worried enough to be considering legal action. Infostrada Sports' Head of Analysis Simon Gleave recently coined the terms Superior 7 and Threatened 13 to describe the two-tier structure that is often said to exist within the Premier League. The increasingly powerful Superior 7 teams are considered to be Manchester United, Manchester City, Arsenal, Chelsea, Liverpool, Tottenham and Everton.

This current 2013/14 season, there has not been a single permanent signing by a ‘Superior 7’ club of a player who played the previous season in the Championship, League One, League Two or the Scottish Premier League.

There’s Plenty Of Fish In The Sea

“…99% of player recruitment is who you don’t buy.”

(Mike Forde, former Director of Football Operations at Chelsea FC)

The 1995 Bosman ruling and the collective economic power of the top European clubs means there is now a vast pool of footballers from across the world to be evaluated every transfer window. There is only a small fraction of the world’s footballers that can be considered 'off the market'. Michael Calvin’s book 'The Nowhere Men' describes how many clubs are finding that traditional scouting methods alone no longer meet their recruitment needs. One way clubs can improve their recruitment process is through detailed analysis of players’ statistical performance. An increasing number of teams are now using statistics to objectively compare players they may wish to sign. Statistical analysis can also help them to assign reasonable transfer values to potential targets.

There has been much criticism of ‘meaningless stats’ and their potential lack of context recently, however full and thorough analysis done well can actually ADD context to decision making.

Go Compare Example 1 – Goal Scorers Just knowing how many goals a striker scores does not necessarily tell us how good a finisher he is. For example, what is the quality of the chances he is being presented with by his teammates? Colin Trainor is leading much of the work in this area.

Was it really not possible to produce chance quality analyses for these goal scorers?

Gary Hooper (63 goals in 3 seasons in the SPL) Jordan Rhodes (70 goals in 3 seasons in L1)

Example 2 – Goal Keepers: Paul Riley uses shot location information for the purpose of rating goalkeeper performance.

How can teams objectively evaluate goalkeeper performance without full data coverage in these leagues?

Fraser Forster (14 goals conceded in 28 SPL games) Wayne Hennessey (£3m signing from League One)

Example 3 - Midfielders: Some of the most criticised statistics in football are those related to passing (otherwise known as the Leon Britton effect). Marek Kwiatowski’s work attempts to address this by comparing the passing (field position, length angle and volume) of central midfielders.

If we know that two players are attempting similar types of passes each game then suddenly a stat such as pass completion percentage does become meaningful.

Liam Bridcutt (121 Championship appearances 2010 to 2014)

Is it merely a coincidence that a Championship midfielder known primarily for his passing was only signed for a Premier League team by one of his former managers?

How many other young players in these leagues might be going unnoticed because of a lack of data coverage?

Even when players are noticed, are Premier League clubs increasingly reluctant to ‘pull the trigger’ on these signings?

Will Hughes (18, Derby County) Thomas Ince (only on loan at Crystal Palace)

How is Data Actually Being Used by Clubs? I wanted to find out more about what data is available and how clubs are actually using it ‘on the ground’. I spoke to several representatives from football clubs at all levels and also direct to data companies. Opta has been producing their full level f24 data for the Premier League for 12 seasons. Full details of which leagues they cover can be seen here but highlights include:

- Germany Bundesliga (9 seasons)

- Italy Serie A (9 seasons)

- Spain La Liga (8 seasons)

- France Ligue One (8 seasons)

- UEFA Champions League (8 seasons)

- Russian Premier League (5 seasons)

- Dutch Eredivisie (4 seasons)

- Portuguese Primeira Liga (4 seasons – 75% coverage)

Leagues that have been added for the 2013/14 season include the Championship, Brazilian Serie A and Argentinian Primera. The level of coverage is expanding every year but, as mentioned earlier, there is not currently the level of demand to cover League One, League Two and Scotland in this detail. Opta is not the only data company however and pure number-crunching is not the only modern technique available. For example data can be now be used in conjunction with tailor-made video analysis via services such as Opta’s VideoHub Elite and Wyscout. One of the first companies in this field was Prozone who now provide both video and data services to over 300 professional clubs worldwide.

The combined use of statistical analysis with worldwide video scouting can be considered together as the modern developments in football player recruitment.

How many clubs are fully embracing these new developments? At what levels are these methods most prevalent? Is it even possible to use these methods the further down the league structure you go? Every club representative I spoke to was interested in the potential impact of incorporating a more data-driven approach to the transfer market. However they also all spoke of the fact that, when it comes to recruitment at least, these techniques are currently in their infancy e.g. “Most teams do minimal stats and rely on traditional scouting and manager input. Only a few teams do what I would call proper statistical analysis of potential transfers”. From this correspondence it seemed initially that the data is not currently available outside the EPL. For example, “I see the work that appears on StatsBomb and it’s very interesting, however I could not replicate it in terms of the League as I don’t have the data to do so” and “From what I know of this XY data is simply not available - I would very much doubt it is even collected by the clubs themselves.” However, when I spoke to representatives from Prozone I was informed that a lot of this data is being recorded. Opta is really the only company to make any data available publicly via the media whereas Prozone and Wyscout’s business models focus on the professional game and provide more bespoke services tailored to the needs of individual clubs as clients.

The reality is that some clubs have access to data that the public and other clubs do not.

Prozone records what they term technical data of 2,500 on-ball events per match. They currently record this for all of the Premier League and Championship and much of League One. Paul Boanas, Senior Account Manager, told me “We work with 23 of the 24 Championship clubs and 10 of the clubs in League One…they all get every touch of the ball in their games, with the vast majority of championship clubs having access to all touches of the ball for all 552 games in their division”. In the Championship this coverage has been in place since 2007 and for League One the last 4 to 5 years. Having increased in coverage over the past 10 years Prozone now provide this level of service 25 leagues worldwide. In addition, all Premier League clubs, 17 Championship clubs and 2 League One clubs now have a fixed-position camera system in place to record player movements!

This presents the even more interesting scenario that the data is out there but it is just not yet being fully utilised by all but a small minority of clubs.

What could be causing this dichotomy? One reason is simply the cost and practicalities of fully using data analytics at a professional football club. The data may be available, but as one person told me “At best a lot of these clubs have 1 full time analyst who is covering everything at first team level” and “Unfortunately football is a business…clubs will feel reluctant to pay for services that they do not appreciate as yet.” Also, much of the focus is understandably placed on analysing one’s own team’s performance (post-match and physical analysis) and also preparing for forthcoming opponents (pre-match). One analyst told me “Things like shot locations for example, I can do this for my club as I have access to each game, but I don’t know how it compares to the rest of the league.” I know from my own experience preparing for the OptaPro Forum that it can take a lot of time and programming skill to get these vast datasets into something approaching a workable format for analysis. The week-to-week practicalities of the football schedule unfortunately do not allow for this kind of time investment.

It is for exactly this reason that Colin Trainor this week put forward an offer of assistance to clubs from all of us at Statsbomb.

Ultimately we cannot be sure exactly what data individual clubs have available and how they are using it – clubs are secretive and if they find a competitive edge will want to hold it for as long as possible. What is clear, however, is that data companies are expanding their coverage all the time and certain clubs are the early adopters embracing new analytic methods. Although not exclusively, this innovation appears to be starting with some of the richest clubs (e.g. Manchester City, Chelsea, Liverpool) but the inevitable trend is that it will feed their way down the football food chain.

What effect might this trend have on teams further down the league ladder? Has this process already started? And can we already see its impact?

In Part Two I will look at how the developing use of data analysis might be impacting the domestic transfer market. Why has transfer revenue outside of the Premier League reduced? How do domestic leagues compare to similar standard leagues worldwide? Where do Premier League clubs now buy their players from and is the transfer market becoming more efficient?

NOTES [Note 1: TransferMarkt historic values for transfer fees are inflated to reflect current market prices. At present I have not received a response from them to confirm the exact method for doing this. It is assumed that this is consistent across world leagues] [Note 2: To account for the demotion of Glasgow Rangers in 2012 the combined revenue from all Scottish divisions is included throughout] [Note 3: Sales by promoted and relegated clubs are counted for the division they were playing in the previous season. E.g. Wigan sold James McCarthy to Everton when they were a officially a Championship club (summer 2013) but because Wigan was relegated the previous season this is counted as a Premier League to Premier League transfer (i.e. it is assumed Everton made the signing on the basis of his performances in the Premier League the previous season). At the other end, Dwight Gayle’s transfer from Peterborough to Crystal Palace is considered Championship to Premier League despite Peterborough’s relegation to League One.]